The factors directly affecting the shape of future rail transport in the region over the next 10-20 years include:

Although overall rail freight growth has been running at about 4% pa for the past decade, demand for particular types of services can and does vary greatly and very rapidly, and freight demand forecasting often involves difficult "chicken and egg" judgments about the likely market-generating impacts of improvements in rail freight services and capabilities.

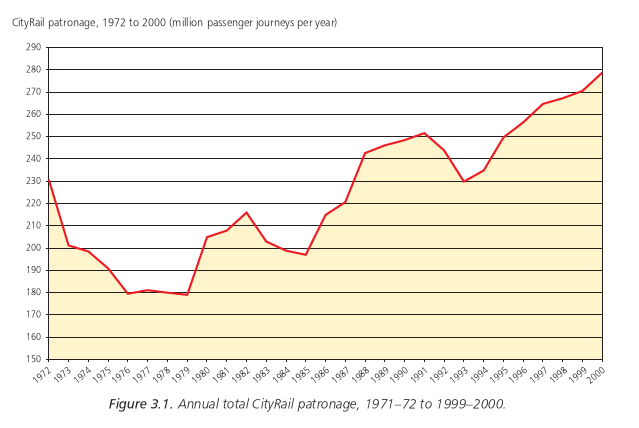

Over the last 20 years CityRail's patronage has increased by an average annual growth rate of 1.55%, outstripping the average annual population increase over the same period of 1.2%.

This growth has not been uniform. Downturns have been experienced during periods of reduced economic activity, followed by faster growth during and following economic recoveries (Figure 3.1), and the growth rate has been much higher on some lines -- particularly those carrying the most passengers, but also on the Central Coast and South Coast lines -- than on others.

In the five years to 1999-2000, for example, total patronage on the

"inner west" lines between Macdonaldtown and Regents Park increased

by 24%, patronage on the Main North and Illawarra lines increased by

20%, patronage on the lower North Shore line increased by 19% and

patronage on the Bankstown line increased by 17% -- but patronage on the

Main West line between Emu Plains and Doonside increased by only 0.2%.

Further, the growth rates experienced for peak period trips -- mainly journeys to work -- have been different to the total patronage patterns just discussed. For example, over the last four years morning peak hour patronage into the Sydney CBD has increased by 21%, but the increases have ranged between 30% for patronage from the North Shore line to only 5% for patronage from the Bankstown line.

Although journeys to work represent only 19% of all journeys in the region, as already indicated they constitute a large proportion of CityRail's peak loadings, especially in the most congested parts of the rail network, and are therefore critical in assessing the likely future peak demand for CityRail services and the consequential needs for increases in the rail system's capacity.

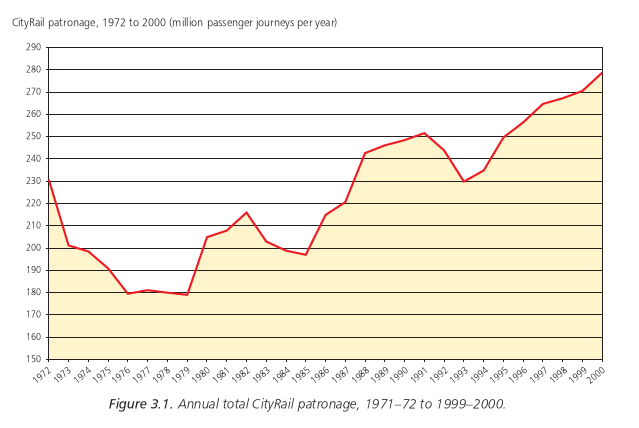

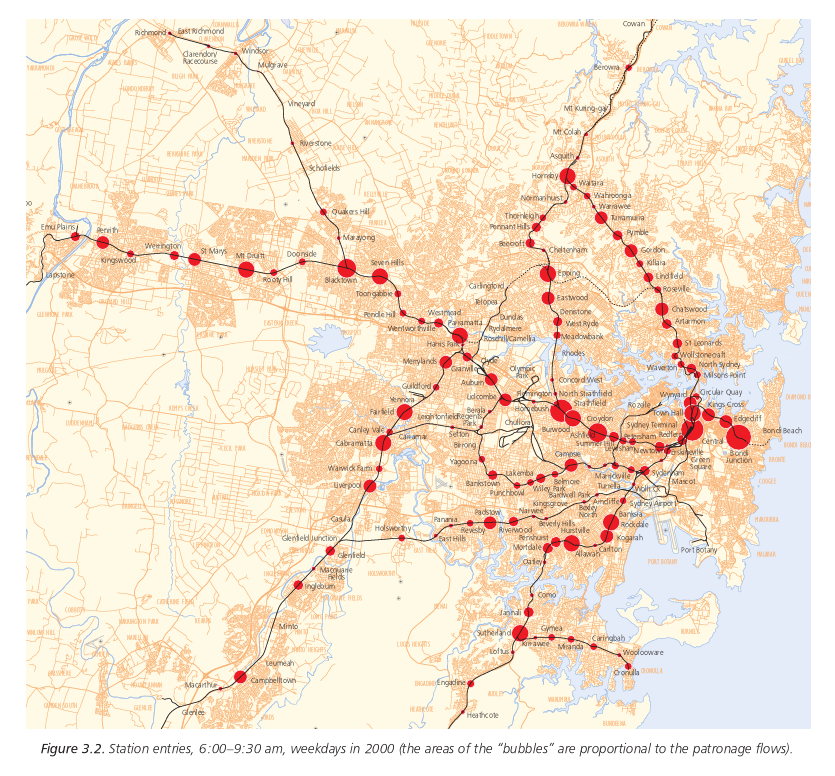

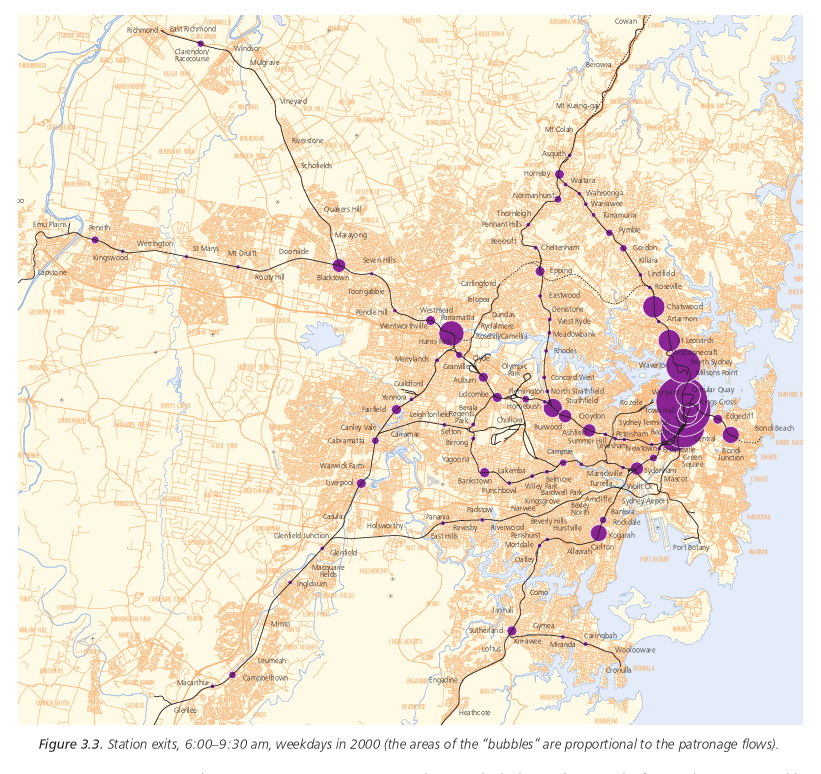

In 1996 about 54% of all rail journeys to work were to the Sydney CBD, 13% were to the lower North Shore, 8% were to Sydney's west, including Parramatta and Blacktown, and 8% were to the inner west, including Strathfield, Burwood and Ashfield.

This pattern is well illustrated by Figures 3.2 and 3.3, which summarise station entry and station exit data for weekday morning peak periods during 2000 (the areas of the "bubbles" are proportional to the patronage flows).

Employment has increased rapidly in the CBD and North Sydney over the

last ten to 15 years, but is expected to increase at a slower rate in

the future with a continuation of the trend to employment at more

dispersed locations in the suburbs and especially in "outer ring"

areas, including new business parks. On the other hand, the swing to

employment in service industries in the finance, property and business

services sectors is expected to continue to concentrate employment in

the major urban centres of the Sydney CBD, North Sydney, Chatswood

and Parramatta, all of which are key rail markets.

There are considerable (and inconsistent) differences in the forecasts of "CBD and inner city" employment growth made by different forecasters.

The Department of Urban Affairs and Planning (DUAP), the Department of Transport's Transport Data Centre (TDC) and a report prepared for Rail Access Corporation by Richard Kirwan in September 2000 all forecast only slow to modest growth in central area employment.

TDC also expects that the increasing residential population of the CBD will absorb many of the new jobs in this area.

As a result, TDC has forecast a total increase in CityRail patronage between 2001 and 2021, assuming no new rail lines are built during this period, of around 16%, or roughly the rate of population increase.

In essence, this is a conservative projection catering for the possibility that future rail patronage will no longer outstrip population growth, even though it has consistently done so, on average, in the past. (TDC's projections for 1996-2001 have already proved to be well below the 4.5% pa CBD patronage growth actually experienced.)

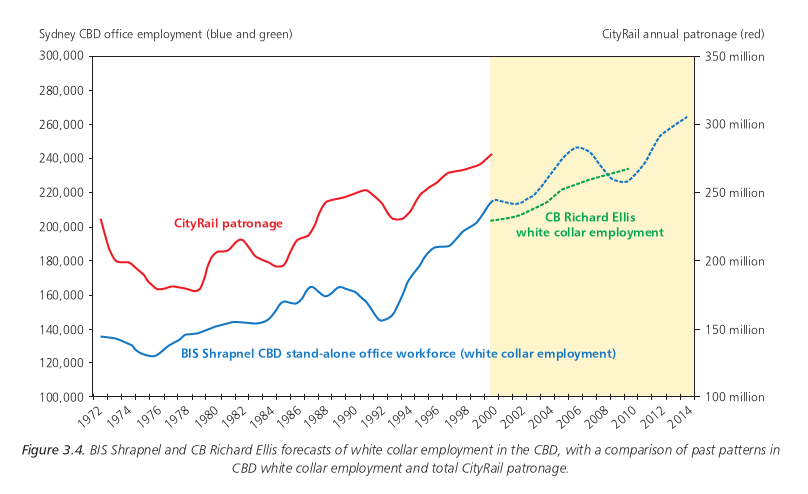

At the other end of the spectrum, BIS Shrapnel and a report prepared

for Rail Infrastructure Corporation by CB Richard Ellis in January

2001 have forecast faster growth in white collar employment in the

CBD, albeit not as fast as in the past (see Figure 3.4, which also

illustrates the similarity of past patterns in CBD white collar

employment and CityRail patronage).

Accordingly, for the purposes of the corridor growth analyses summarised in section 4.4 below, four patronage growth scenarios have been tested:

In Action for Air and Action for Transport 2010 the Government set an ambitious target of a halt to the growth of total vehicle kilometres travelled in the greater metropolitan region by 2021, as a necessary part of moves to prevent an unacceptable degradation of air quality in the region.

Action for Air predicted that to achieve this target public transport's mode share would need to increase by almost 50% from 1996 to 2021. Later RIC and SRA studies suggest that even if bus and ferry patronage increases as fast as rail patronage, a rail mode share increase closer to 60% will be required.

In order to achieve the Action for Air/Action for Transport 2010 target, it is now estimated, after allowing for population growth as forecast by the Department of Urban Affairs and Planning, that:

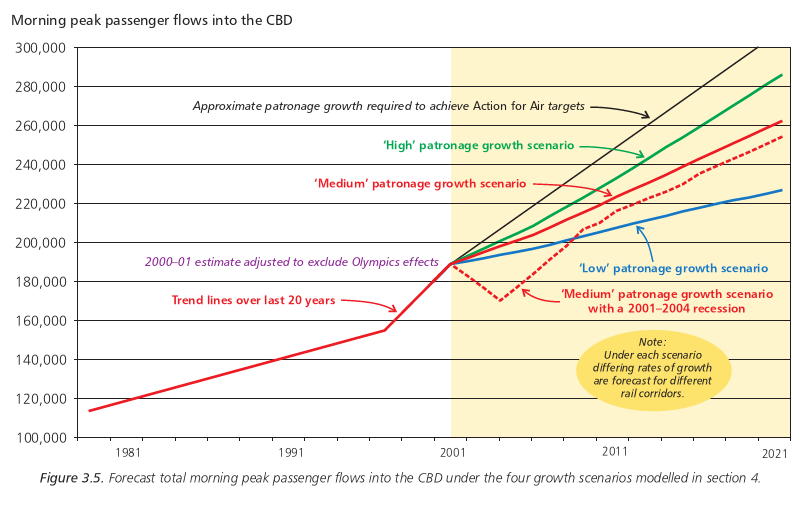

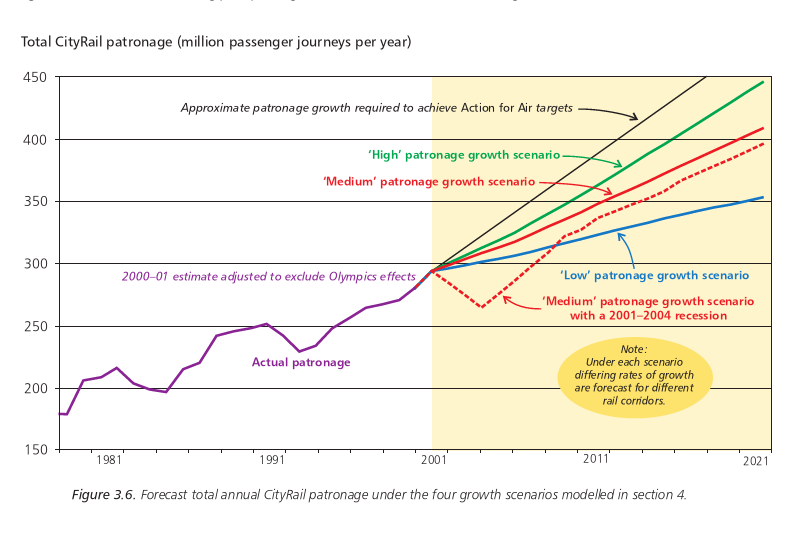

As illustrated in Figures 3.5 and 3.6, all four of the patronage

growth scenarios modelled, reflecting the range of different

predictions of likely patronage growth, fall well short of the

patronage growth required for the Government's Action for Air/Action

for Transport 2010 target to be achieved.

Despite this shortfall, the scenarios reflect the best advice

currently available to the Office of the Coordinator General of Rail

on realistically likely patronage growth. The plans and projects

identified in sections 4, 5 and 6 as necessary for the accommodation

of the forecast likely growth would

need to be significantly accelerated if the rail system had to be

developed to cope with the growth rate targeted in Action for Air and

Action for Transport 2010.

Because the growth rate assumptions behind the plans and projects identified as necessary in section 4, 5 and 6 are clearly identified, the timings and priorities of the various projects will be able to be adjusted in the light of the growth rates actually experienced in the future.

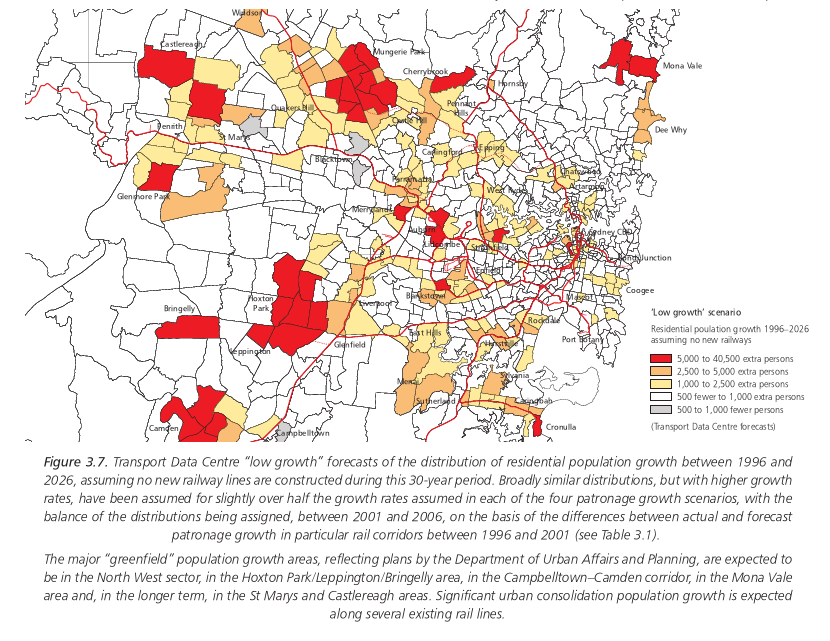

As already indicated, the growth rates under the four "likely growth" scenarios have not been applied uniformly to all rail corridors in modelling possible future corridor patronage.

Instead, slightly over half of the growth rate assumed under each scenario has been distributed between the various lines in accordance with a 1996 SRA forecasting model based on distributions of population and employment in these corridors, broadly using growth distributions predicted by TDC (Figures 3.7 and 3.8) but with higher overall growth rate assumptions, and the balance has been distributed between the various lines -- but only until 2006 -- in accordance with higher-than-forecast growth patterns in recent years, reflecting factors such as road congestion, CBD car parking shortages, rapid population growth near particular stations and local initiatives to increase rail patronage. After 2006 this component has been assumed to be equal for all lines (Table 3.1).

To illustrate the effects of these adjustments, under the "medium growth" scenario, with an assumed total increase in morning peak passenger flows into the CBD of 36% between 2000 and 2016, the increases for various lines over the same period have varied between 24% and 48%, with the fastest rates of increase being on the intercity lines (albeit from a much smaller patronage base than the suburban lines) and on the East Hills and North Shore lines and with the lowest rate of increase being on the Bankstown line (Table 3.1).

The factors likely to affect patronage growth in each of the corridors over the next 5-10 years are described below. The results of the corridor patronage analyses using the four scenarios for patronage growth are presented in section 4.4.

The recent rapid growth of patronage on this line has

arisen mainly from significant urban consolidation along the

Illawarra and Cronulla lines, especially around Hurstville,

Sutherland and Rockdale stations, which are served by "fast" and

"semi-fast" CityRail trains, but also at other centres such as

Kogarah.

| Table 3.1. Morning peak period corridor patronage growth assumptions under the "medium growth" scenario (at the "CBD cordon" locations described in section 4.4) | |||||||||

| Corridor | Morning peak patronage (7:00 am to10:00 am) | Current annual growth rate | Growth from 2001 to 2006 | Growth from 2006 to 2011 | Growth from 2011 to 2016 | Total growth from 2000 to 2016 | |||

| Component based on SRA 1996 land-use based forecasts | Other growth component (based on 1996-2001 growth not forecast in 1996) | Component based on SRA 1996 land-use based forecasts | Other growth component (assumed uniform) | Component based on SRA 1996 land-use based forecasts | Other growth component (assumed uniform) | ||||

| Illawarra | 28,990 | 4.7% | 2.8% | 13.1% | 2.9% | 3.8% | 2.8% | 3.8% | 38% |

| Eastern Suburbs | 15,552 | 3.7% | 1.0% | 13.6% | 0.9% | 3.8% | 1.2% | 3.8% | 28% |

| South Coast | 3,750 | 8.7% | 3.6% | 21.7% | 1.7% | 3.8% | 3.4% | 3.8% | 48% |

| East Hills | 20,510 | 3.5% | 6.3% | 5.1% | 4.2% | 3.8% | 3.4% | 3.8% | 42% |

| Bankstown | 12,190 | 0.9% | 1.8% | 4.3% | 1.7% | 3.8% | 2.1% | 3.8% | 24% |

| South / Inner West | 23,050 | 4.8% | 2.3% | 11.0% | 3.1% | 3.8% | 2.2% | 3.8% | 35% |

| West | 24,840 | 1.2% | 4.5% | 8.3% | 2.1% | 3.8% | 2.4% | 3.8% | 30% |

| Blue Mountains | 3,970 | 7.4% | 5.2% | 17.6% | 3.3% | 3.8% | 3.2% | 3.8% | 48% |

| Main North | 11,450 | 2.3% | 3.5% | 7.7% | 3.0% | 3.8% | 2.0% | 3.8% | 31% |

| Central Coast | 9,202 | 5.9% | 6.0% | 18.2% | 3.2% | 3.8% | 3.1% | 3.8% | 47% |

| North Shore | 24,900 | 2.3% | 2.3% | 4.6% | 2.1% | 3.8% | 2.1% | 3.8% | 39% |

| Total | 178,405 | 5.6% | 8.0% | 9.4% | 8.9% | 36% | |||

|---|---|---|---|---|---|---|---|---|---|

This urban consolidation has provoked considerable local community debate, and it is expected that the overall pace of development will slow over the next few years. The market is well tuned to this type of development, however, and the areas close to the city and with good train services are likely to see increased growth as competition with other parts of Sydney becomes less intense.

Major developments are planned for around Wolli Creek station. Development applications for at least 2,500 dwelling units and major employment and commercial activities are currently before Rockdale Council. (These developments are not taken into account in the "low growth" TDC modelling shown in Figures 3.7 and 3.8.)

The proposed Cooks Cove development could also increase demand on the line, as could a number of the station and interchange improvements planned for locations where existing interchange facilities such as commuter car parks and bus services are already unable to cope with demand (see sections 4.4 and 4.6).

The population of the South Coast south of Thirroul is growing rapidly, with the Wollongong, Shellharbour and Kiama local government areas all experiencing considerable urban growth, as the area provides an affordable "overflow" housing area for Sydney.

While there is some urban consolidation, most of the growth is from major "greenfield" developments, mainly by Landcom.

There is likely to be significant continued growth in demand on the South Coast line for commuting to Sydney, assisted by the commencement of the major West Dapto development within the next five years, the electrification of the Dapto-Kiama line, the proposed new Oak Flats interchange and station, the proposed Flinders station (adjacent to 3,500 dwellings) and the inability of the RTA to upgrade Mount Ousley Road because of land slip problems.

With the exception of the development proposals for Wolli Creek mentioned above, there has been relatively little urban consolidation pressure on the inner sections of the East Hills line, largely because of the predominance of single residences erected in the 1940s and 1950s along this line.

This situation is unlikely to persist, however. The sale of Department of Defence holdings in Padstow and the availability of significant numbers of large residential blocks along the line are likely to entice developers over the next five years (the Department of Defence developments are not factored into the TDC predictions in Figure 3.7).

Improved bus services from outlying areas such as Menai to Padstow are also likely to develop as the East Hills line is amplified, increasing patronage on this line while taking some pressure off the Illawarra line.

Further to the west, the Department of Defence is proposing the development of 800 new dwellings within walking distance of Holsworthy station plus a major new development in about five years -- ultimately with more than 12,000 residents and more than 30,000 jobs -- near Moorebank Avenue, to be served by a new Georges River station (again, these developments, not being part of DUAP plans, are not factored into the TDC predictions in Figures 3.7 and 3.8). An expansion of the Holsworthy station car parking facilities, which are already unable to cope with demand, is also planned, and this could trigger a further growth in demand.

Greenfield development sites are now scarce in existing urban areas in the Glenfield to Macarthur (Main South line) corridor. There are already increasing pockets of urban consolidation, and infill development is being encouraged by DUAP in preference to further development south of Macarthur. The impacts of this policy are expected to be gradually felt over the next five years.

The proposed new Glenfield-Leppington line (see section 5) will serve new urban release areas planned by DUAP and other residential developments on Department of Defence and other land in the Bardia area not shown in Figure 3.7. This line will affect both patronage and train operations on the entire corridor from Glenfield to the CBD.

Pressure is mounting for improved public services to and from the urban growth areas around Camden. This demand is initially likely to be met by express bus services, potentially increasing CityRail patronage demand to and from Campbelltown. The topography of the area and the extensive development that has already occurred between Camden and Campbelltown mean Camden would be very difficult to serve adequately with a new heavy rail line, but light rail services might provide increased capacity for the "feeder" services in the longer term.

The eastern part of the Bankstown line is starting to see pockets of urban consolidation, and there are opportunities for major urban consolidation around the site of the former railway carriage sheds in Punchbowl.

Bankstown is rapidly developing as a major employment centre, and this trend is expected to continue, increasing the importance of Bankstown as a destination.

A Department of Defence development near Regents Park station, creating about 350 new dwellings, is not expected to have a major impact on Bankstown line patronage.

In recent years there has been some substantial urban consolidation along the Old South line between Liverpool and Granville. Although the prime sites have been developed, there are still opportunities for further development along this line.

Some increase in rail demand is expected to result from the new Parramatta-Liverpool transitway, which is now expected to be completed in 2003. The Liverpool station and interchange redevelopment has already increased demand.

There are few opportunities for residential or employment development between Sefton and Cabramatta in the short term, as the area is largely industrial and there are superior land development opportunities elsewhere. More significant redevelopment can be expected in this corridor in the longer term.

Some 400 dwelling units are now under construction around Homebush, and more are planned within two years. Strathfield and Burwood are also experiencing significant urban consolidation, and again more is expected in the next few years.

The proposed new Pippita station (see section 4.6) could place some minor additional demands on the Inner West line in the short term, but more significant pressure, especially on interchanging at Strathfield, is likely to come from the rejuvenation of old industrial areas near the Olympic precinct, the proposed Parramatta-Strathfield bus transitway and proposed new bus services from Granville to Strathfield along Parramatta Road.

Burwood will continue to grow as a sub-regional commercial, retail and employment area, and State Transit intends to increase its bus services to Burwood by 50% over the next few years. The current station and interchange are ill equipped for these tasks, but if they are redeveloped (as proposed) Burwood could become a major station, affecting other stations in the Inner West.

A DUAP Urban Improvement Policy is being developed for the Homebush-Strathfield-Burwood area, with a major focus on increasing the mode share of public transport.

Further to the east, more than 400 new dwellings are being built within 400 m of Croydon and Ashfield stations, and more are being planned.

Further east again, there is considerable "gentrification" along the Inner West to Macdonaldtown station, and this is producing considerable increases in patronage at all these stations, with the highest rate of increase being at Newtown, because of the high density of existing dwellings and increasing urban consolidation in this area.

Major redevelopments are planned for Redfern over the next few years. If current negotiations for major global hightechnology companies to establish their southeast Asian headquarters at the Australian Technology Park are successful, up to 12,000 people could be employed on this site, and this would have a major impact on Redfern station. The station's capacity may also come under stress from proposed new bus services between the station and the University of New South Wales, assisted by planned improvements to bus stops south of the station.

Urban consolidation between Parramatta and Toongabbie is driving up rail demand, and this trend is expected to continue with the reinforcement of Parramatta as a major regional centre.

Further west, however, there is little urban consolidation on the Main West line west of Blacktown, and most new developments are more than 5 km from a station. As a result, patronage growth in this corridor is patchy, at best, and St Marys, with declining retail and industrial areas adjacent to the station, is experiencing some patronage decline.

There are, however, opportunities for increases in demand on the Main West. 2,000 new unit dwellings are being developed by the Department of Defence on a site next to Penrith station, and 350 or more new dwellings are planned by the Department of Defence for a new residential and commercial precinct next to the site of the proposed University of Western Sydney station between Werrington and Kingswood.

The largest planned development, however, is on the ADI site north of St Marys, with approximately 8,000 dwellings. If it proceeds, this development will be linked by a bus transitway to both Penrith and St Marys stations.

In addition, there are numerous other former industrial and commercial sites along the Main West line which could be redeveloped for residential purposes within the next ten years if the local councils adopted favourable planning policies.

Negotiations are underway for a 20-storey residential, retail and commercial tower on the northern side of Blacktown station, with direct pedestrian links to the station.

The Richmond line is experiencing considerable patronage growth, and more is likely in the near future, especially from the rapidly developing North West sector. This line will bear the brunt of rail demand growth from the Rouse Hill area until the proposed Epping-Castle Hill-Mungerie Park line is built at some time in the next ten to 20 years (see section 5).

Blacktown Council is about to exhibit rezoning plans for 1,100 hectares north of the Richmond line between Schofields and Riverstone. When this area is fully developed it will house some 30,000 people. As discussed in section 5, it will be important to ensure that a corridor for a future Mungerie Park-Vineyard rail link is reserved as part of the rezoning of this area within the next 12 months.

The Department of Defence is proposing to redevelop the former HMAS Nirimba site between Quakers Hill and Schofields for up to 1,400 dwellings. This will necessitate the construction of a new Nirimba station to serve this "landlocked" site.

There are limited opportunities for further patronage growth on the Blue Mountains line. Although there are some pockets of urban consolidation in the lower mountains, opportunities for greenfield developments are severely constrained by topographic, environmental and bushfire safety limitations.

Patronage on this line is growing rapidly. There are large pockets of urban consolidation at major centres along the line, and with the advent of the Epping-Chatswood line in 2008 there are likely to be further strong increases in demand.

Patronage growth remains strong in the Hornsby area, and urban consolidation is starting to filter towards West Pennant Hills. However, the two strongest urban consolidation areas are between Epping and Meadowbank and between Rhodes and North Strathfield. Demand in these areas is expected to grow dramatically in the next five years, and the Epping- North Strathfield corridor is expected to be one of the largest growth segments for CityRail over the next decade. (This expectation is not mirrored in the modelled "extra growth" distributions shown in Table 3.1, which are conservatively based only on growth which has actually occurred in the last five years.)

Some 2,000 to 3,000 new dwellings are expected to be built along the line north of Parramatta River, 3,000 are expected around Rhodes station, which will be redeveloped at the developers' cost (see section 4.6), large numbers of new dwellings are expected around Concord West, the former Arnotts' biscuit factory site may be redeveloped and 1,000 new dwellings are expected to be developed on a site north of North Strathfield station. There are also numerous other sites for smaller scale redevelopments.

This corridor is also a growing area for employment in high-technology industries and financial services.

Patronage on the Central Coast line has grown rapidly in the last decade.

While most of the opportunities for greenfield growth are now moving north into the northern part of Wyong Shire, there are still limited opportunities close to the railway in the Gosford Council area.

At the same time there are significant opportunities arising from urban consolidation around Gosford and Wyong, much of it close to the major stations, as these areas mature.

Up to 40,000 new residents are likely to move into the northern part of Wyong Shire in the next ten years. The area is regarded as one of the last with affordable housing, and large tracts of land have been acquired by Landcom. A major new urban centre is to be developed around Warnervale, necessitating the construction of a new bus-rail interchange station some 1.5 km north of the existing station.

The lower North Shore has been subject to major urban consolidation for a long time, but this is expected to continue with renewed vigour in the next decade with increasing numbers of high-rise apartments. The advent of the Epping- Chatswood line is expected to accelerate this process.

Chatswood and St Leonards are expected to further consolidate with multi-function retail, commercial, employment and residential developments close to and dependent on the railway. They will continue to grow as regional centres, and because parking is already constrained their future growth will increasingly depend on good bus and rail public transport links.

North Sydney will also continue to grow in size and complexity. North Sydney Council is anxious to increase floor space ratios in the North Sydney business district to attract the overflow from the Sydney CBD, but the viability of this will depend on a substantial increase in the capacity of North Sydney station.

The most pressing demand issue on the North Shore line, however, is

the development of close links between the North Shore, the Sydney

CBD, the Eastern Suburbs and the Airport. Once the Epping-Chatswood

line is operational this nexus will become particularly important for

the high-technology employment zone around North Ryde, as it will

provide a vital link to other parts of the Sydney region essential to

these industries' operations.